Big Moves: June 19, 2025

What moved today and why? Coinbase, Mastercard, Visa, Planet Fitness, Zoetis and more

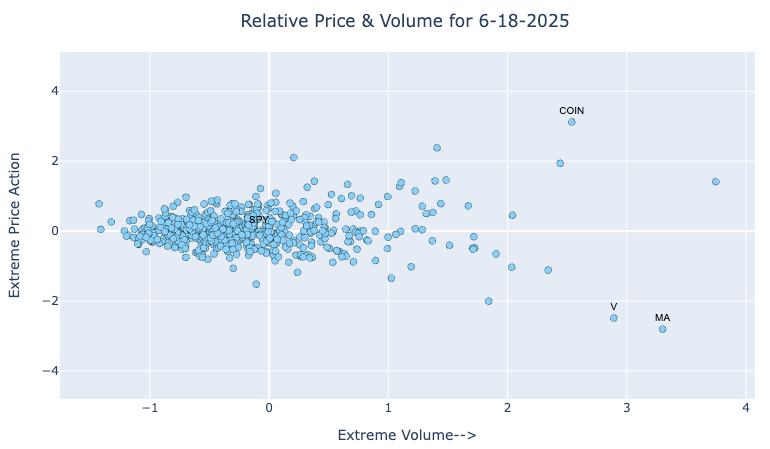

Two Sides Of The Same COIN

Whether a piece of news is good or bad depends on what side you're on. Coinbase surged Wednesday on the Senate’s passage of the GENIUS Act; MasterCard and Visa very much went the other way. The bill lays the groundwork for regulated stablecoin issuance. It has energized crypto-aligned firms while rattling traditional payment processors, whose perceived moat against competition has made them long time favorites of hedge fund investors. Read more below.

For new readers, one of the main motivations behind starting Big Price Moves Explained was to have a reason to actively engage with AI on a daily basis—learning by doing. I maintain active editorial oversight over topic selection, model, and platform choices, but pretty much everything below this point is written by AI.

A quick preview of Wednesday’s notable moves:

Regulatory Shift: The passage of the GENIUS Act sent crypto-aligned firms soaring while weighing down traditional financial players, as investor sentiment pivoted sharply toward stablecoin-enabled infrastructure.

Sector Divergence: While Coinbase* rallied on clearer crypto regulations and a new product launch, legacy payment giants like Mastercard* and Visa* tumbled on fears their dominance could erode under a stablecoin-powered future.

Unexpected Momentum: Planet Fitness* advanced on the strength of a teen-targeted summer campaign, showing how non-financial news can still drive significant market moves.

Analyst Drag: Zoetis slipped despite no new company developments, with a brokerage downgrade and rising competitive pressures undercutting investor confidence.

* These companies have the pros and cons discussed on their earnings calls or in other materials summarized in the Read section below.

Skim

This is where you come to quickly see if anything interesting is happening with names you care about. Think of it as informative advertising.

Coinbase Global Inc (COIN) - Financial Exchanges & Data (295.29 | +16.32%) Coinbase shares surged 16.32% following the U.S. Senate's passage of the GENIUS Act, which introduces a regulatory framework for stablecoins. This legislative clarity is seen as a major win for Coinbase, which benefits directly from the growth and adoption of regulated stablecoins like USDC. In addition, Coinbase launched “Coinbase Payments,” a USDC-based payment platform that integrates with Shopify, boosting its role in crypto commerce and enhancing investor confidence. Sources: Business Insider, Investopedia

Mastercard Incorporated (MA) - Financial Services (538.73 | -5.39%) Mastercard declined 5.39% after the passage of the GENIUS Act raised concerns that increased adoption of regulated stablecoins could displace traditional card networks. Investors reacted to the potential long-term threat to Mastercard’s core transaction processing business as digital assets gain a stronger legal foothold. Sources: Business Insider, Investopedia

Visa Inc (V) - Financial Services (340.38 | -4.88%) Visa fell 4.88% for similar reasons as Mastercard, with investor fears mounting that the GENIUS Act’s endorsement of stablecoins could undercut Visa's transaction volumes and margins over time. The law's emphasis on blockchain-based payments poses a competitive risk to traditional payment processors. Sources: Business Insider, Investopedia

Planet Fitness Inc (PLNT) - Leisure Facilities (107.69 | +4.89%) Planet Fitness gained 4.89% driven by strong engagement from its annual “High School Summer Pass” initiative, which allows teens to work out for free during summer. The campaign is generating above-expected foot traffic and sign-ups, contributing to positive sentiment about member growth and franchise expansion potential. Sources: Seeking Alpha

Zoetis Inc (ZTS) - Pharmaceuticals (155.06 | –4.09%) Zoetis dropped 4.09% after Stifel downgraded the stock from “Buy” to “Hold” and lowered its price target to $160. The downgrade was based on rising competition in dermatology and parasite prevention products, as well as slowing international growth and pressure from rivals like Merck and Elanco. Sources: Barron’s

Powered by BigData.com, Big Price Moves Explained; text generated by GPT-4o

Read

In this section we offer a bit more detail in a couple of featured names.

Coinbase Global Inc (COIN) - Financial Exchanges & Data (295.29 | +16.32%)

Mastercard Incorporated (MA) - Financial Services (538.73 | -5.39%)

Visa Inc (V) - Financial Services (340.38 | -4.88%)

Senate Passes Landmark Stablecoin Bill, Sparking Stock Surge for Coinbase, Slide for Card Networks

Stablecoins are emerging as a potential disruptor to traditional payment networks, with major retailers like Walmart and Amazon exploring their implementation to bypass the 2–3% transaction fees charged by Visa and Mastercard, potentially saving billions annually in processing costs.

GENIUS Act Regulatory Framework

The U.S. Senate recently passed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) with a vote of 68 to 30, marking the first major digital asset legislation to pass either Congressional chamber. This landmark bill establishes federal oversight for stablecoin issuers, requiring them to maintain full reserve backing through Treasuries or cash, conduct monthly audits, and comply with anti-money laundering regulations.

Critically, the legislation empowers non-financial entities—including retailers, tech firms, and airlines—to issue dollar-backed digital currencies that could bypass traditional card networks entirely. This regulatory breakthrough provides the clear framework that major corporations have been waiting for, removing a significant barrier to stablecoin adoption and potentially accelerating the timeline for implementation of alternative payment systems that directly challenge the decades-long dominance of traditional payment processors.

Retailer Stablecoin Initiatives

Major retailers are actively exploring stablecoin implementations that could fundamentally disrupt the payment processing industry. Walmart and Amazon have engaged in discussions about issuing their own cryptocurrency tokens, with potential annual savings of approximately $15.6 billion and $13.8 billion respectively by switching from traditional 2.5% payment fees to 0.1% stablecoin processing costs. These retail giants, along with Expedia and several major airlines, see stablecoins as an opportunity to streamline global payments while retaining control over payment infrastructure.

The economic incentives are compelling beyond mere cost savings. Retailers could potentially earn interest on the reserves backing their stablecoins and gain ownership of customer loyalty programs and data that currently reside with payment providers. This shift represents a fundamental power transfer in the payment ecosystem, with retailers poised to reclaim billions in fees that have historically enriched traditional payment networks.

Financial Impact on Payment Networks

The market reaction to stablecoin developments has been severe, with Visa and Mastercard experiencing combined market capitalization losses exceeding $60 billion following initial reports of retailer stablecoin plans. On June 13, 2025, Visa shares plummeted 7.1% while Mastercard fell 6.2%, marking the worst one-day drop in about two months for both stocks. The negative trend continued on June 18, with both payment processors among the top losers on the S&P 500. This dramatic market response reflects growing investor recognition that stablecoins represent an existential threat to the traditional payment duopoly, potentially disrupting their "ironclad" system of interchange fees that generates 50%+ profit margins.

Coinbase's Strategic Benefits

In stark contrast to payment processors, Coinbase experienced dramatic stock appreciation following the GENIUS Act's passage, with shares surging 11.9% and leading S&P 500 gainers on Wednesday. This positive response stems largely from Coinbase's lucrative revenue-sharing agreement with Circle, which provides approximately 50% of the interest income generated from USDC stablecoin reserves. This arrangement has become increasingly significant, with USDC-related revenue representing 15% of Coinbase's $2 billion in Q1 2025 revenue and generating $297 million in interest income during that quarter alone.

The regulatory clarity provided by the GENIUS Act addresses a persistent regulatory overhang that has weighed on Coinbase's valuation relative to fintech peers. Industry experts predict the stablecoin market could grow from $228 billion to $2.8 trillion by 2028, which would directly benefit Coinbase through its Circle partnership. Chief Legal Officer Paul Grewal praised the 68 Senators who supported the bill, viewing the legislation as essential for maintaining U.S. competitiveness in the global digital asset market.

Guided by Big Price Moves Explained; Sourced and written with Perplexity.ai in Deep Research mode [link with citations]

Planet Fitness Inc (PLNT) - Leisure Facilities (107.69 | +4.89%)

Planet Fitness Stock Climbs Nearly 5% as Teen Summer Pass Drives Membership Surge

Running from June 1 to August 31, the High School Summer Pass initiative represents a substantial investment of over $300 million in waived membership dues since its inception. The program addresses critical health concerns among teenagers, with studies showing only 25% of teens complete the recommended hour of daily physical activity, while 94% of American teens report struggling emotionally and mentally.

The 2024 iteration of the program demonstrated remarkable success, with nearly 3 million high school students participating and logging more than 12 million workouts across Planet Fitness locations in the US and Canada. This engagement has proven valuable for long-term business growth, as historical data indicates that more than 11% of teen participants eventually convert to paid memberships. For 2025, the company has partnered with U.S. gymnast and 2-Time Olympic Medalist Stephen to promote the program and further boost participation.

Stock Performance Impact

The 4.89% gain on June 18 pushed Planet Fitness stock near its 52-week high of $110.00, with shares reaching an intraday high of $108.69 on a volume of 2,431,776 shares. This positive movement reflected growing investor confidence in the company's growth strategy, particularly as the stock has gained 8.24% year-to-date. Financial analysts have responded enthusiastically to these developments, with Stifel upgrading Planet Fitness from Hold to Buy with a price target of $120, while Canaccord Genuity Group raised their target to $126 and maintained a "buy" rating. The stock's performance represents a significant recovery from earlier volatility, having traded as low as $68.75 within its 52-week range and experiencing a 4.5% drop just one day prior on June 17.

Membership Growth Metrics

The first quarter of 2025 showcased impressive membership growth for the fitness chain, with approximately 20.6 million members reported at the end of Q1—an increase of about 900,000 from the end of 2024. System-wide same-club sales rose 6.1% in Q1, exceeding expectations and reinforcing the company's positive growth trajectory. Foot traffic data has been particularly encouraging, with monthly visit increases ranging from 4.1% to 11.6% in previous quarters, a trend that appears to be continuing with the current High School Summer Pass program.

The company's financial outlook remains strong, with projections indicating continued expansion throughout 2025. Management expects system-wide same-club sales growth to remain in the 5% to 6% range and overall revenue to increase by approximately 10%. This growth is supported by Planet Fitness's multi-tiered membership model, offering standard memberships at $10–15 per month and premium Black Card memberships at $24.99–29.99 per month, with the latter providing additional amenities and privileges across all locations.

Franchise Expansion Strategy

The franchise-heavy business model, with 90% of clubs being franchised, enables Planet Fitness to maintain low capital intensity while driving substantial revenue growth. This strategy proved effective in Q1 2025 with the opening of 19 new clubs (16 franchise-owned and 3 corporate-owned), bringing the global total to 2,741 locations. Looking ahead, the company plans to open 160–170 new clubs throughout 2025, continuing its international expansion into markets including Spain and Australia.

Multiple revenue streams support this expansion, including:

Membership fees from standard and premium subscriptions

Franchise fees and royalties from franchise owners

Equipment sales to franchisees, which saw a 28.7% revenue surge to $27.8 million in Q1

Retail merchandise and sponsorship income

This diversified approach, combined with the company's focus on capturing the Gen Z demographic through initiatives like the High School Summer Pass, positions Planet Fitness for continued growth with forecasted earnings and revenue increases of 14.6% and 10.3% per annum respectively.

Guided by Big Price Moves Explained; Sourced and written with Perplexity.ai in Deep Research mode [link with citations]

Disclaimer: The information contained in this newsletter is intended for educational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions. Additionally, please note that we at e/r/c advisors may or may not have a position in any of the companies mentioned herein. This is not a recommendation to buy or sell any security. The information contained herein is presented in good faith on a best efforts basis; note that most of the writing is undertaken by AI—rely on it at your own risk.