Big Moves: May 27, 2025

What moved today and why? Hologic, Etsy, AutoZone and more

Monopolies Are Not Always Enduring

I try not to harp on any single name too much, but Fair Isaac is making itself hard to ignore. To put a finer point on it, the stock is down over 30% in the past week. The decline started last Tuesday after FHFA Director Bill Pulte asked on X, “Why do some credit reports cost double (Biden’s term) what they did during President Trump’s first term?”

Big price moves happen when investors are surprised. Sometimes the surprise is relatively minor, but conditions are what they are. Other times, the shock can feel existential. These are about core assumptions being called into question, not simply forecasts gone wrong. The twin assumptions presently in focus for Fair Isaac are related—its credit score monopoly and exceptional pricing power.

The aforementioned tweet by FHFA Director Pulte clearly puts the topic of pricing power on the table. That he wraps it in a Trump vs. Biden context gives investor concerns more weight. But that’s not all! Pulte has also questioned the credit scoring ecosystem that provides FICO with its monopoly position. Click here to see a report Google’s Gemini 2.5 Flash wrote upon my request. Read below for a shorter summary.

For new readers, one of the main motivations behind starting Big Price Moves Explained was to have a reason to actively engage with AI on a daily basis—learning by doing. I maintain active editorial oversight over topic selection, model, and platform choices, but pretty much everything below this point is written by AI.

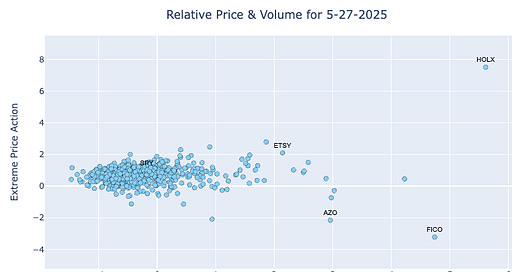

A quick preview of Monday’s notable moves:

M&A Buzz: Investor enthusiasm surged for Hologic, Inc.* on acquisition rumors and a rejected buyout offer, overshadowing usual caution and driving shares sharply higher.

Policy Headwinds: Regulatory pressures and concerns over cost-effectiveness weighed heavily on Fair Isaac Corp. (FICO)*, fueling sharp declines in share prices.

Product Improvements: Etsy Inc. shares climbed as the launch of a new payment option bolstered confidence in the company’s growth potential.

Profit Woes: Revenue beats at AutoZone Inc. failed to offset earnings misses and cost concerns, leading to declines despite strong topline growth.

* These companies have the pros and cons discussed on their earnings calls or in other materials summarized in the Read section below.

Skim

This is where you come to quickly see if anything interesting is happening with names you care about. Think of it as informative advertising.

Hologic, Inc. (HOLX) - Medical Supplies (+14.54%) Hologic, Inc. (HOLX) shares rose 14.54% on May 27, 2025, due to reports that private equity firms TPG and Blackstone made a buyout offer to acquire the company for over $16 billion, valuing the shares at $70-$72 each, which represents a significant premium over the prior closing price. Although Hologic declined the initial offer, the possibility of resumed negotiations kept investor interest high, driving the stock price upward. Sources: MT Newswires, Morningstar, Benzinga, Yahoo! Finance

Fair Isaac Corp. (FICO) - Software (-11.26%) Fair Isaac Corp. (FICO) is down -11.26% primarily due to ongoing concerns raised by Federal Housing Finance Agency Director Bill Pulte about FICO’s pricing and the push for more cost-effective credit evaluation options. This has led to a substantial decline in FICO’s stock value over the past week, with shares losing about 30% of their value. Additionally, the recent adjustment by Autonomous Research, which lowered FICO’s price target from $888 to $852, likely contributed to the negative sentiment surrounding the stock. Sources: Yahoo! Finance, Associated Press, MT Newswires, Seeking Alpha, Benzinga

Etsy Inc (ETSY) - General Retailers (+6.05%) Etsy Inc (ETSY) is up 6.05% on the day due to the introduction of a new payment option, allowing US buyers to make instant bank payments via Stripe. This enhancement provides a faster, more secure, and cost-effective purchasing experience, likely contributing to positive investor sentiment and increased stock value. Sources: Associated Press, Forbes.com via Web, Yahoo! Finance, Retail Technology Innovation Hub

Autozone Inc. (AZO) - General Retailers (-3.42%) AutoZone Inc. (AZO) is down 3.42% due to reporting third-quarter earnings per share of $35.36, which missed the analyst consensus estimate of $37.17. Despite an increase in quarterly sales to $4.46 billion, surpassing the street view of $4.35 billion, the company’s gross margin decreased by 77 basis points compared to the previous year, primarily due to higher inventory shrink and other cost pressures. Additionally, operating profit decreased by 3.8% and net income fell by 6.6% from the same period last year. Sources: MT Newswires, Benzinga

Powered by BigData.com, Big Price Moves Explained; text generated by GPT-4o

Read

In this section we offer a bit more detail in a couple of featured names.

Fair Isaac Corp. (FICO) - Software (1503.62 | -11.26%)

The Proposed Transition from Tri-Merge to Bi-Merge Credit Scoring: A Nuanced Threat to FICO's Revenue Stream

The proposed transition from tri-merge to bi-merge credit reporting, part of the Federal Housing Finance Agency's Enterprise Credit Score and Credit Reports Initiative, presents a nuanced rather than catastrophic threat to FICO's revenue stream. The company's diversified business model, strategic price increases, and ongoing implementation delays provide significant buffers against potential revenue erosion in its core mortgage scoring business.

Tri-Merge vs. Bi-Merge Framework

A tri-merge credit report consolidates information from all three major credit bureaus—Experian, Equifax, and TransUnion—providing a comprehensive view of a consumer's credit history. Traditionally, mortgage applications required reports from all three bureaus, with the middle score determining interest rates and eligibility, establishing consistent demand for FICO's scoring services across the mortgage sector.

In fall 2022, the Federal Housing Finance Authority proposed shifting to a "bi-merge" framework, where only two credit reports would be required per mortgage application, with the scores averaged to determine lending terms. This potential one-third reduction in required credit reports has raised significant industry concerns about data completeness and accuracy. TransUnion's analysis found that bi-merge could render "two million consumers becoming ineligible for a mortgage backed by the GSEs" due to missing credit information, as not all creditors report to every bureau. This implementation challenge, coupled with the framework now being optional rather than mandatory, suggests a gradual rather than immediate impact on FICO's mortgage-related scoring volume.

FHFA's Credit Initiative Impact

The FHFA's Enterprise Credit Score and Credit Reports Initiative extends beyond the bi-merge transition, mandating a dual-phase plan requiring lenders to use both FICO® Score 10T and VantageScore® 4.0 models for single-family loans sold to Fannie Mae and Freddie Mac. This mandate fundamentally challenges FICO's historical near-monopoly by introducing VantageScore 4.0 as a direct competitor, which can score approximately 37 million "credit invisible" Americans by requiring only one month of credit history and incorporating alternative data like rent and utility payments.

Implementation timelines have been notably fluid, reflecting industry pushback and operational complexities. Initially set for Q1 2024, the deadline was pushed to Q4 2025, and as of January 16, 2025, revised to a "to-be-determined date" with bi-merge becoming optional rather than mandatory. Industry stakeholders, including the Mortgage Bankers Association and Independent Community Bankers of America, have consistently raised concerns that the initiative is "overly complex, costly to consumers, and missing key requirements necessary for a successful transition," arguing it creates "significant regulatory uncertainty and operational complexity" that could "increase costs for lenders and consumers."

FICO's Revenue Structure

FICO's financial structure reveals a robust business with two primary revenue streams: Scores and Software. In Q2 FY2025, the company reported total revenues of $498.7 million, with the Scores segment contributing $297.0 million (60%) and the Software segment providing $201.7 million (40%). The Scores segment, encompassing both B2B and B2C solutions, functions as the company's "primary growth engine," demonstrating impressive 25% year-over-year growth driven largely by strategic price increases rather than volume expansion.

Mortgage-related revenue constitutes a significant 44% of FICO's B2B sales, highlighting its importance to the core business. The company has demonstrated substantial pricing power, recently increasing its wholesale price on mortgage application credit scores from $3.50 to $4.95, a move that drew criticism from CFPB Director Chopra, who noted that credit reporting companies now pay approximately $10 for a tri-merge bundle, with costs doubling for joint borrowers. This regulatory scrutiny suggests potential limitations on FICO's future ability to offset volume declines with price increases, introducing a long-term risk to its revenue growth trajectory.

Strategic Resilience Measures

FICO has implemented robust countermeasures to navigate the evolving credit landscape, with its Software segment providing a critical hedge against potential Scores revenue declines. This segment generated $201.7 million in Q2 FY2025 (40% of total revenue) with platform Annual Recurring Revenue growing at 17%, allowing FICO to leverage its analytical expertise across financial services, insurance, telecommunications, and retail industries.

Alternative data integration represents another key defensive strategy, with FICO developing proprietary solutions like FICO® Score XD and FICO® Score X Data. These models incorporate phone and utility payment history, public records, and asset insights to score previously "credit-invisible" consumers. FICO Score XD can generate credit scores for over 70% of applicants with thin or no credit files, addressing approximately 53 million Americans (25 million "credit-invisible" consumers and 28 million with insufficient credit reports) while directly competing with VantageScore on financial inclusion capabilities.

Guided by Big Price Moves Explained; Sourced and written with Gemini 2.5 Flash [link with citations]

Hologic, Inc. (HOLX) - Medical Supplies (62.17 | +14.54%)

Hologic Rejects $16 Billion Buyout Bid From TPG, Blackstone as Shares Surge 15%

Hologic Inc. shares surged 14.54% on May 27, 2025, after reports emerged that the women's health-focused medical technology company rejected a non-binding buyout offer exceeding $16 billion from private equity firms TPG and Blackstone. This would have valued shares at $70-72 each—a significant premium over the previous closing price of $54.28.

Buyout Offer Details

The proposed acquisition valued Hologic between $16.3 billion and $16.7 billion, including debt, representing one of the largest leveraged buyouts of 2025. The offer would have priced shares at $70-$72—approximately 30% above Hologic's Friday closing price of $54.28.

Despite the generous premium, the company rejected the non-binding proposal in recent weeks. However, sources indicated that negotiations could potentially resume. The timing of the offer coincided with Hologic facing significant headwinds, as its stock had dropped about 24% year-to-date, pressured by U.S. tariffs and softening demand in key market segments.

Market Response Analysis

The stock market responded enthusiastically to the buyout news, with Hologic shares climbing from $54.28 to $62.17 on May 27, 2025, amid extraordinary trading volume of 19.27 million shares—far exceeding the average of 3.24 million. Intraday volatility was significant, with the stock trading between $54.52 and $68.25 as investors processed both the premium offer and Hologic's subsequent rejection. Despite the company declining the initial proposal, the sustained price elevation suggests investors remain optimistic about potential future negotiations or alternative strategic outcomes.

The broader market context also supported Hologic's gains, as U.S. equities posted broad-based advances that day. The S&P 500 rose 1.9%, extending May's gains to more than 6% amid falling Treasury yields and improved investor sentiment. This positive market environment likely amplified the response to Hologic's buyout news, creating favorable conditions for the stock's dramatic single-day performance.

Hologic's Financial Performance

Despite recent market challenges, Hologic demonstrated resilient financial performance in the second quarter of 2025, reporting adjusted earnings of $1.03 per share, matching the previous year and beating analyst consensus of $1.02. While sales decreased 1.2% year-over-year to $1.05 billion, this still exceeded market expectations of $1 billion. The company maintained strong financial health with $169.5 million in operating cash flow and substantial liquidity of $1.43 billion in cash and equivalents, plus $192 million in short-term investments.

Performance varied across business segments, with Breast Health Service Revenue growing impressively at 12% to reach $212.6 million (21% of total revenue), while the Diagnostics division generated $453.6 million, growing 1.5% or 5.2% when excluding COVID-related sales. However, facing macroeconomic headwinds including tariff uncertainties, Hologic lowered its fiscal 2025 adjusted earnings guidance from $4.25-4.35 to $4.15-4.25 per share, with third-quarter projections of $1.04-1.07 per share against consensus expectations of $1.10.

Future Acquisition Prospects

The rejection of TPG and Blackstone's initial offer doesn't necessarily close the door on Hologic's potential acquisition. Negotiations could resume despite the initial rejection, leaving shareholders optimistic about future premium opportunities. This possibility has kept investor interest high, contributing to the stock's sustained elevation above pre-offer levels.

Hologic has previously been an acquisition target, most notably when activist investor Carl Icahn acquired a 12.5% stake in 2013, which led to significant leadership changes including the appointment of current CEO Steve MacMillan. The company's focus on women's health represents an attractive market segment with long-term demographic advantages, while its established positions in diagnostics and breast health provide stable revenue streams that private equity firms could potentially optimize through operational improvements and market expansion strategies.

Guided by Big Price Moves Explained; Sourced and written with Perplexity.ai in Deep Research mode [link with citations]

Disclaimer: The information contained in this newsletter is intended for educational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions. Additionally, please note that we at e/r/c advisors may or may not have a position in any of the companies mentioned herein. This is not a recommendation to buy or sell any security. The information contained herein is presented in good faith on a best efforts basis; note that most of the writing is undertaken by AI—rely on it at your own risk.